what is yield to maturity on a bond

What is the Yield to Maturity (YTM)?

Yield to Maturity (YTM) – otherwise referred to as redemption or volume yield – is the speculative rate of return or interest rate of a fixed-rate security, such equally a bail . The YTM is based on the belief or understanding that an investor purchases the security at the electric current market price and holds it until the security has matured (reached its full value), and that all interest and coupon payments are made in a timely mode.

How YTM is Calculated

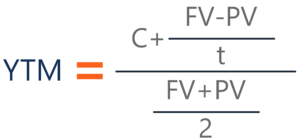

YTM is typically expressed as an annual percentage rate (April) . It is determined through the use of the following formula:

Where:

- C – Involvement/coupon payment

- FV – Face value of the security

- PV – Nowadays value/price of the security

- t – How many years it takes the security to reach maturity

The formula's purpose is to determine the yield of a bond (or other fixed-asset security) co-ordinate to its most contempo market toll. The YTM adding is structured to testify – based on compounding – the effective yield a security should take once information technology reaches maturity. It is different from simple yield, which determines the yield a security should accept upon maturity, just is based on dividends and not compounded interest .

Approximated YTM

It's important to sympathize that the formula higher up is just useful for an approximated YTM. In lodge to summate the true YTM, an analyst or investor must use the trial and error method. This is done by using a multifariousness of rates that are substituted into the current value slot of the formula. The true YTM is determined once the cost matches that of the security'south actual electric current market price.

Alternatively, this process tin can be sped up by utilizing the SOLVER part in Excel, which determines a value based on atmospheric condition that tin be set. This means that an analyst tin can set the nowadays value (price) of the security and solve for the YTM which acts as the interest charge per unit for the PV calculation.

Acquire more about how to use SOLVER with CFI'due south free Excel Modeling Fundamentals Course!

Example of a YTM Calculation

To become a better agreement of the YTM formula and how information technology works, let's look at an example.

Presume that there is a bond on the market priced at $850 and that the bond comes with a face value of $1,000 (a fairly common confront value for bonds). On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bail will reach maturity in 7 years.

The formula for determining approximate YTM would look like below:

The approximated YTM on the bond is eighteen.53%.

Importance of Yield to Maturity

The primary importance of yield to maturity is the fact that it enables investors to draw comparisons between different securities and the returns they tin expect from each. It is critical for determining which securities to add to their portfolios.

Yield to maturity is also useful as it too allows the investors to proceeds some understanding of how changes in marketplace conditions might affect their portfolio because when securities drib in price, yields rise, and vice versa.

Boosted Resources

Thank you for reading CFI'southward guide to Yield to Maturity. If you are looking to acquire more almost fixed income securities, check out some of the CFI resources below!

- Fixed Income Fundamentals

- Equity vs Fixed Income

- Held to Maturity Securities

- Matrix Pricing

Source: https://corporatefinanceinstitute.com/resources/knowledge/finance/yield-to-maturity-ytm/

0 Response to "what is yield to maturity on a bond"

Post a Comment